Monte Carlo simulations are a powerful tool for understanding complex systems and making calculated decisions. However, implementing these simulations can be laborious. Fortunately, mtrich.net provides a user-friendly platform to accelerate the process. With its intuitive interface and extensive features, mtrich.net empowers you to effectively create and run Monte Carlo simulations for a wide range of applications.

- Concerning financial modeling to risk assessment, mtrich.net offers a comprehensive suite of functionalities to suit your specific needs. Its flexible design allows you to tailor simulations to reflect the intricacies of your chosen domain.

- Utilizing its built-in libraries and functions, mtrich.net simplifies the process of generating random numbers, performing statistical analysis, and visualizing simulation results. Its clear interface makes it accessible to both beginners and experienced users.

- Via employing Monte Carlo simulations with mtrich.net, you can gain valuable knowledge about the potential outcomes of your decisions and make more confident choices.

Unlocking Financial Insights with Stochastic Simulations

Financial forecasting is a inherently complex process, rife with uncertainty and potential for unforeseen events. Utilizing Monte Carlo analysis offers a robust framework to navigate this complexity by generating thousands of possible future scenarios. By incorporating various inputs, including market fluctuations, interest rate movements, and operational parameters, Monte Carlo simulations provide invaluable understandings into the potential range of financial outcomes. This methodology empowers decision-makers to make more calculated choices by quantifying risk, identifying opportunities, and ultimately improving their financial position.

Financial Risk Management: A Guide to Monte Carlo Methods

In the realm throughout financial risk management, Monte Carlo methods emerge as a powerful instrument for measuring uncertainty. These simulation-based approaches leverage random sampling to model complex systems and predict potential outcomes under various scenarios. By iteratively running multiple simulations, analysts can gain a in-depth understanding of the spectrum of possible results, allowing for informed decision-making. Monte Carlo methods find applications in a wide array throughout financial domains, including portfolio optimization, credit risk analysis, and derivative pricing.

- Additionally, Monte Carlo simulations can successfully capture the relationship between different variables, providing a more accurate representation of financial markets.

- Despite their computational intensity, Monte Carlo methods offer invaluable insights that strengthen risk management practices and facilitate sound investment strategies.

Predict Tomorrow : Powerful Monte Carlo Tools at Your Fingertips

Unleash the power of prognosis with Monte Carlo simulations! These revolutionary tools allow you to explore a wide range of potential outcomes, empowering you to make calculated decisions. With just a few clicks, you can visualize complex systems and achieve valuable insights into the future. Whether you're in finance, engineering, or any other field that requires probability analysis, read more Monte Carlo simulations offer a powerful framework to navigate complexity and make smarter choices.

- Leverage the power of random sampling to generate thousands of possible scenarios.

- Identify potential risks and opportunities with unprecedented clarity.

- Optimize your strategies based on evidence-based insights.

Introducing mtrich.net: Your Comprehensive Monte Carlo Solution

mtrich.net is a sophisticated online platform focused on providing cutting-edge Monte Carlo simulation solutions. Whether you're engaged with scientific research, mtrich.net offers a {widevast selection of features to accomplish your detailed modeling needs. Our {intuitive interface makes Monte Carlo simulation understandable even for individuals with limited experience.

- Leverage the power of randomness with our extensive library of probability distributions.

- Generate realistic simulations for numerous applications.

- Evaluate simulation results with sophisticated visualization and reporting tools

From Theory to Practice: Applying Monte Carlo in Real-World Scenarios

Monte Carlo simulation has long been a powerful theoretical tool within the realm of probability and statistics. But its true potential shines when translating these theories into practical, real-world applications. Consider scenarios like financial management, where Monte Carlo methods can be used to predict likely market fluctuations and improve investment strategies. Similarly, in engineering design, modeling complex systems with inherent randomness, such as stress distributions on a bridge, becomes manageable through Monte Carlo techniques. Highlighting the flexibility of Monte Carlo in these diverse applications emphasizes its crucial role in modern problem-solving.

Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Ben Savage Then & Now!

Ben Savage Then & Now! Hailie Jade Scott Mathers Then & Now!

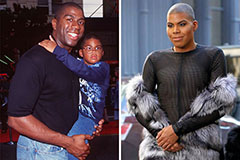

Hailie Jade Scott Mathers Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Lisa Whelchel Then & Now!

Lisa Whelchel Then & Now!